We deliver custom, hands-on financial literacy workshops designed for vulnerable youth.

Our programs are tailored to address the unique roadblocks and needs of foster youth, equipping participants with the skills to budget, save, avoid debt, borrow smart, invest in themselves, and stay protected from financial pitfalls.

Proudly partnered with organizations committed to advancing youth financial empowerment.

At Financial Futures Education, every workshop is built around one goal: empowering youth to take control of their financial future.

Custom financial literacy workshops tailored to youth needs.

We collaborate closely with your staff and students to understand their real needs, challenges, and goals. Together, we design a financial literacy program that tackles common misconceptions and roadblocks — something no off-the-shelf course can do. The result is a curriculum that resonates deeply and builds real-world financial capability.

Led by expert educators and mentors who connect with youth.

Our facilitators are trained directly on your custom curriculum to ensure seamless delivery and authentic engagement. They’re not just educators — they’re mentors who connect with youth, build trust, and bring energy into every classroom. With backgrounds in banking, communication, business, and social impact, they create genuine connections and make every session impactful.

Interactive and fun workshop delivery that engages youth.

We bring learning to life through games, simulations, and guided conversations. By keeping activities hands-on and language simple, we make financial topics approachable, relatable, and genuinely fun — helping students build confidence that lasts.

We believe financial education should be engaging, inclusive, and life-changing.

Watch this short video to learn who we are and why we started Financial Futures.

Programs We Offer

Curious about our workshops? Here’s how we deliver financial literacy for foster youth. Choose the format that fits your needs.

Standalone Workshops

Targeted, one-time sessions focused on tackling key financial challenges. These can be booked as needed, or repeated for new groups.

Cohort-Format Workshops

Interactive sessions covering all 5 financial pillars, spread over several weeks. Each cohort wraps up with a graduation ceremony, celebrating every participant’s progress and achievements.

Drop-in Tutoring Sessions

Ongoing support, either on-site or virtual. Youth can drop in and get 1:1 help from our educators, bringing their own questions and concerns in a personalized setting directly.

Proven impact

100%

learned something new about financial literacy.

92%

would recommend our program to a friend.

85%

now feel confident creating a financial budget.

87%

developed new financial goals.

Our Five Financial Pillars

Five clear, actionable principles form the foundation of our curriculum.

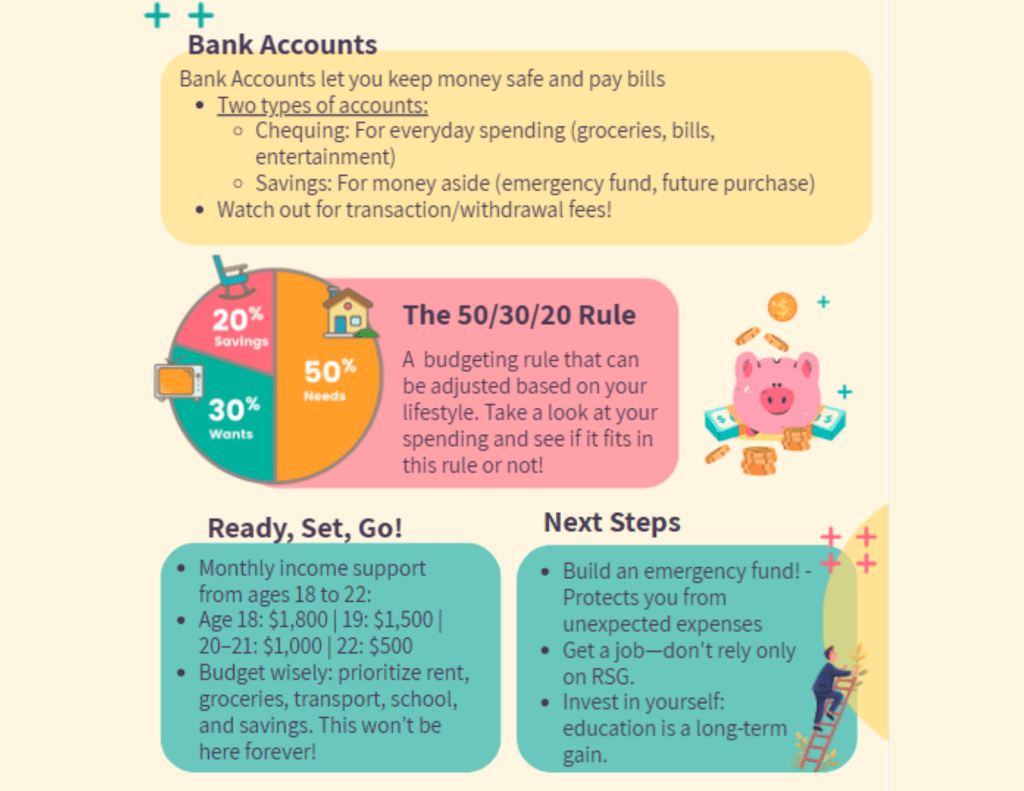

Spend

Learn responsible spending and budgeting

Save

Tips and tools for building savings habits

Borrow

Understand debt, loans, and safe borrowing

Invest

Invest money in yourself and your future

Protect

Guard against scams, fraud, and risks

Why choose us?

Our process is personal, collaborative, and partnership-focused, so every session connects meaningfully with the students who need it most.

Try Before You Commit

We offer trial sessions so your organization can experience our approach and curriculum firsthand before committing to a program.

Ongoing Support

Our tutoring program provides follow-up sessions and one-on-one mentoring, ensuring youth continue to build confidence and deepen their financial skills over time.

Practical Resources

Every participant receives personalized tip sheets summarizing concepts and tools from workshops, helping them apply what they learn long after the sessions end.

Funding Assistance

Concerned about budget? We actively assist organizations in securing grants and funding, making it easier to bring high-quality financial literacy education to your youth without financial barriers.

“Our team has been especially impressed by Financial Futures’ collaborative approach. Their facilitators work seamlessly with our staff to plan, adjust, and deliver sessions that reflect the real-life experiences of our youth. They demonstrate flexibility, clear communication, and a genuine commitment to creating a safe, empowering environment where youth feel supported to dream big, build confidence, and set personal financial goals.”

Peel Children’s Aid Foundation

Our Partner

Curious about the driving force behind Financial Futures Education?

Founded and led by young professionals who understand the unique challenges vulnerable youth face.

Sanya Bajaj

Co-founder

An experienced educator with a background in banking and communications, Sanya empowers youth to build lasting financial confidence through inclusive, practical education.

Shifaa Syed

Co-founder

With expertise in business, marketing, and entrepreneurship, Shifaa brings a dynamic, and relatable approach to teaching vital financial skills, focusing on applied financial literacy education.

FAQs

Who is eligible for your workshops?

Any youth part of your organization can participate. We also work with youth agencies, family service groups, and organizations supporting vulnerable youth.

Can you customize the curriculum for our group’s needs?

Yes! Every program is designed in collaboration with your team, so our curriculum directly addresses your youth’s specific challenges and interests. No two workshops are alike — everything is tailored for your students.

How much do your programs cost, and what if we have no budget?

We work with each client to find a payment structure that fits, and we actively help agencies apply for grants or secure funding. No youth should miss out because of cost. Reach out to us to discuss options.

How do we book a workshop or get started?

Just reach out directly (via our Contact Us page or email), and we’ll set up a discovery call to understand your needs and walk you through next steps — including trial sessions where you can preview our teaching and content.

We’re active on LinkedIn.

Follow our journey, see testimonials, and connect with our team for program updates and thought leadership in youth financial literacy.

Ready to empower your youth?

Book a free discovery call to see how we can customize your curriculum, demonstrate sample content, and meet your team.

- Custom financial literacy programs built for vulnerable youth

- Lifelong skills to budget, save, and invest in their future

- Grant-supported partnerships, so cost is never a barrier